When we are using FIFO or LIFO, we have to consider that small products bought in bulk are rarely individually assigned the costs they were originally purchased at. The exception to this would be large items like cars or appliances or very expensive pieces of jewelry. But in general they are all dumped into one bin and pulled out when sold. One other major consideration of this costing method is that it can become significantly skewed over time if prices are rising or falling. You assign the average cost of $13 per shirt to each of these buckets – 75 shirts sold and 225 left over in inventory.

What Types of Companies Often Use FIFO?

We also still have all 100 shirts of the second tranche at $15 per shirt, so our ending inventory balance is $3,000. You now have a total of 300 shirts that you invested a total of $3900 in. Now, let’s look at each inventory method, the pros and cons of each, and discuss how it can impact your business.

Average Cost

LIFO usually doesn’t match the physical movement of inventory, as companies may be more likely to try to move older inventory first. However, companies like car dealerships or gas/oil companies may try to sell items marked with the highest cost to reduce their taxable income. If a company wants to match sales revenue with current cost of goods sold, it would use LIFO. If a company seeks to reduce its income taxes in a period of rising prices, it would also use LIFO. On the other hand, LIFO often charges against revenues the cost of goods not actually sold.

Example of LIFO

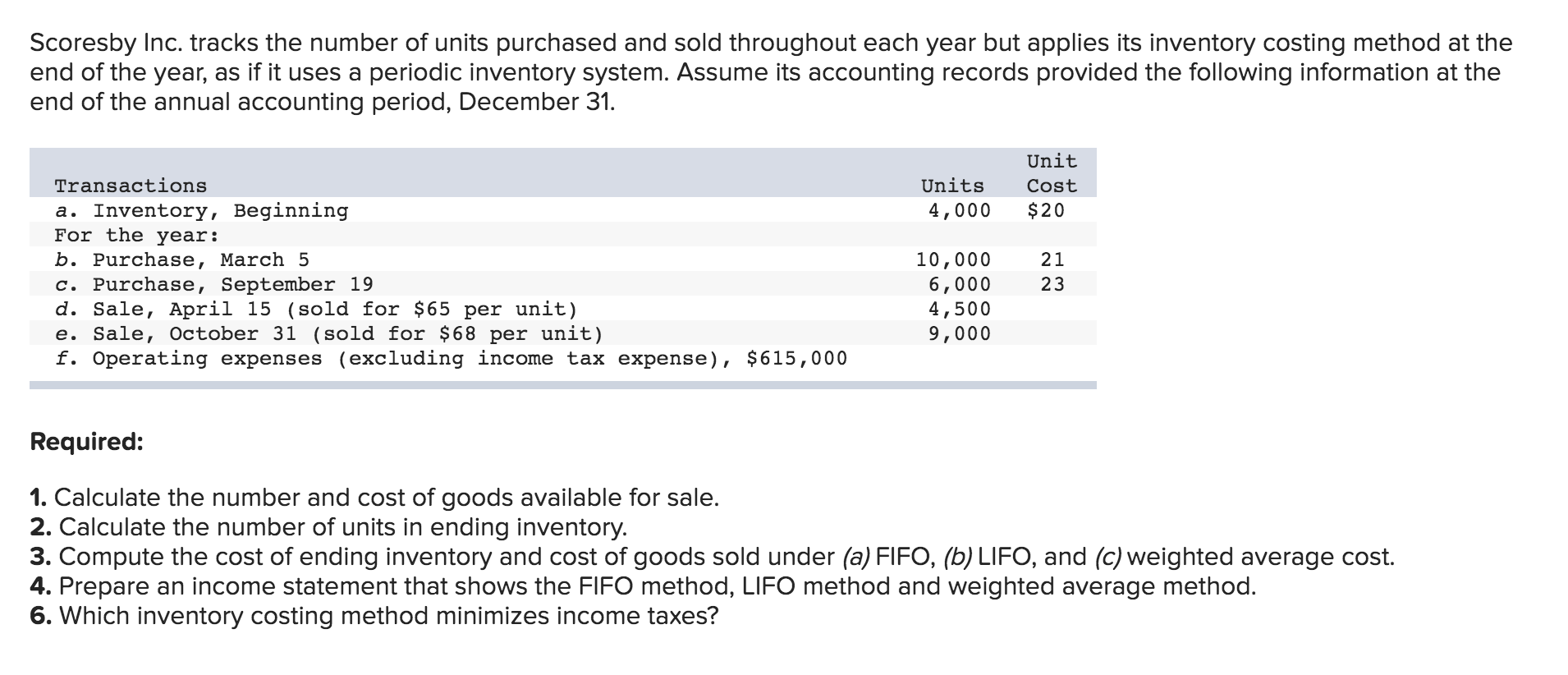

Because the expenses are usually lower under the FIFO method, net income is higher, resulting in a potentially higher tax liability. The average cost method takes the weighted average of all units available for sale during the accounting period and then uses that average cost to determine the value of COGS and ending inventory. In our bakery example, the average cost for inventory would be $1.125 per unit, calculated as [(200 x $1) + (200 x $1.25)]/400. Those who favor LIFO argue that its use leads to a better matching of costs and revenues than the other methods.

- As you can see, the inventory method a company uses affects its cost of goods sold, which impacts profitability.

- Basically, unless you are turning over 100% of your inventory before buying more, the first items bought never actually show as sold.

- LIFO supporters claim this upward trend in prices leads to inventory, or paper, profits if the FIFO method is used.

- We place products in pricing tiers when they are bought and then make a general assumption on the order that those pricing tiers will pulled off the shelf and sold.

Small businesses using straightforward accounting procedures may choose to utilize the periodic inventory method because of the simplicity it can provide. It doesn’t require a high level of operational maturity and can still provide accurate financials with less work. The second criticism—that LIFO grossly understates inventory—is valid. A company may report LIFO inventory at a fraction of its current replacement cost, especially if the historical costs are from several decades ago. LIFO supporters contend that the increased usefulness of the income statement more than offsets the negative effect of this undervaluation of inventory on the balance sheet. Most companies that use LIFO inventory valuations need to maintain large inventories, such as retailers and auto dealerships.

With the Periodic Inventory System, inventory and cost of goods sold accounts are updated periodically. Those using a periodic inventory system will do so periodically (maybe once a month or once a year). With a Perpetual Inventory System, inventory and cost of goods sold accounts are updated with each sale, or perpetually. Companies outside of the United States that use International Financial Reporting Standards (IFRS) are not permitted to use the LIFO method. Companies within the U.S. have greater flexibility on the method they may choose and can opt for either LIFO or FIFO.

For investors, inventory can be one of the most important items to analyze because it can provide insight into what’s happening with a company’s core business. The difference between $8,000, $15,000 and $11,250 is considerable. So, which inventory figure a company starts with when valuing its inventory really does matter. And companies are required by law to state which accounting method they used in their published financials. The company made inventory purchases each month for Q1 for a total of 3,000 units. However, the company already had 1,000 units of older inventory that was purchased at $8 each for an $8,000 valuation.

LIFO is opposite of FIFO and reports the most current prices as being cost of goods sold. So, why do so many businesses neglect inventory and fail to establish a method for valuing one of their biggest assets & expenses? Inventory management can be intimidating, and is made more so due to the multiple approaches you can take. In contrast, using the FIFO method, the $100 widgets are sold first, followed by the $200 widgets.

For example, assume that a company bought three identical units of a given product at different prices. One unit cost $ 2,000, the second cost $ 2,100, and the third cost $ 2,200. The units are alike, the inventory costing method that results in the lowest taxable income in a period of rising costs is: so the customer does not care which of the identical units the company ships. However, the gross margin on the sale could be either $ 800, $ 700, or $ 600, depending on which unit the company ships.

Last in, first out (LIFO) is only used in the United States where any of the three inventory-costing methods can be used under generally accepted accounting principles (GAAP). The International Financial Reporting Standards (IFRS), which is used in most countries, forbids the use of the LIFO method. However, please note that if prices are decreasing, the opposite scenarios outlined above play out. In addition, many companies will state that they use the “lower of cost or market” when valuing inventory. This means that if inventory values were to plummet, their valuations would represent the market value (or replacement cost) instead of LIFO, FIFO, or average cost.